Plus, receive recommendations and exclusive offers on all of your favorite books and authors from Simon & Schuster.

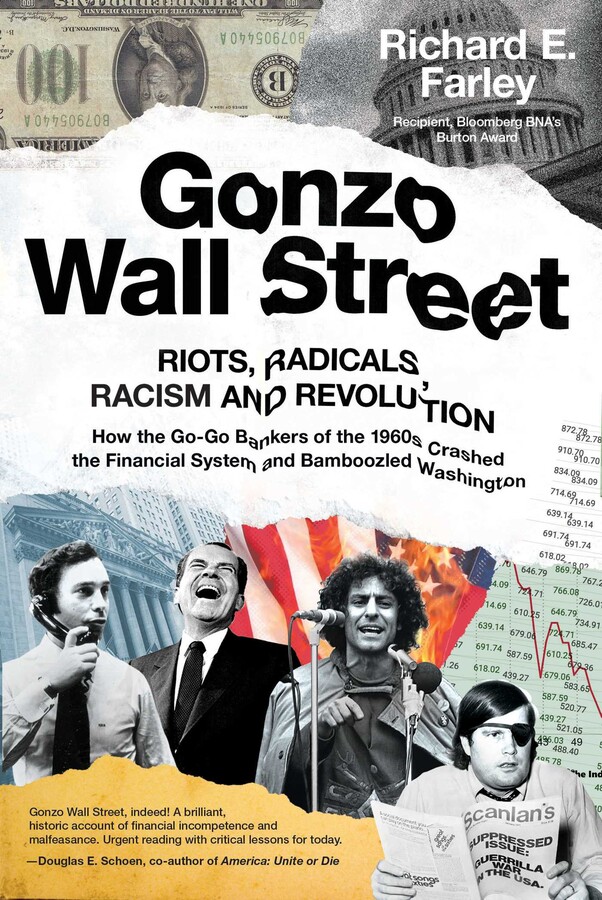

Gonzo Wall Street

RIOTS,RADICALS,RACISM AND REVOLUTION: How the Go-Go Bankers of the 1960s Crashed the Financial System and Bamboozled Washington

Table of Contents

About The Book

In the 1960s, the fabric of American society was torn apart by deep divisions over the Vietnam War, violence in our cities, and the senseless assassinations of President John F. Kennedy, Martin Luther King Jr., and Senator Robert Kennedy. Civil rights, as well as women’s and gay liberation movements, were challenging America. Music, literature, fashion, and “substances” were transforming the culture and upending conventional morality and manners. The public, the media, and politicians, preoccupied with these dramatic changes, paid little attention to Wall Street, where a crisis was brewing that would cause more investment banks to fail than during the Great Depression.

The year 1968 should have been the best of times on Wall Street. It was the greatest bull market since the Roaring ’20s. The Dow was breaking records. Trading volume was exploding. A hot IPO market for high-flying technology companies was defying gravity. And a swashbuckling mergers and acquisitions wave was generating enormous profits. Despite how flush Wall Street firms looked to outsiders, in truth, they were not a thundering herd but one in need of culling.

Hidden from view was the fact that many of the best-known firms on Wall Street were in very precarious financial positions. Rather than investing in desperately needed state-of-the-art computer systems, the executives of these firms overpaid themselves, leaving them overextended and overleveraged. When business exploded in 1968, they were so overwhelmed by the stacks of stock certificates piled from floor to ceiling that their antiquated back offices were unable to process them.

The New York Stock Exchange (NYSE), under the oversight of the Securities and Exchange Commission (SEC), was the principal regulator of the Wall Street firms at the time. The NYSE still had many of the vestiges of the private club it was prior to the Depression-era laws that created the SEC and brought Wall Street under the control of the federal government. The NYSE even referred to itself as the “Club,” controlled by an old guard of firms that were among the most overleveraged. Through means legal, and likely illegal, this old guard kept many insolvent firms open while keeping the SEC and Congress in the dark until it was too late. With a systemic financial crisis at hand, the boom turned to bust and they went, hat in hand, to Washington for a bailout.

This is the long-hidden history of how the Wall Street investment banks held Congress over a barrel and got a taxpayer-funded guarantee of what they owed their customers—and how little Congress and the SEC got from Wall Street in return. More than anything else, this set the precedent for the bailouts of the 2008 Financial Crisis—and the next Wall Street bailout.

In a story that unfolds throughout the tumultuous 1960s, during the administrations of Kennedy, Johnson, and Nixon, a surprising cast of famous and infamous characters play roles: Abbie Hoffman, Roy Cohn, Ross Perot, Donald Regan, Michael Bloomberg, Felix Rohaytn, Sandy Weill, Ken Langone, and many others.

The stranger than fiction stories include:

—Tino De Angelis, the Salad Oil Swindler who took down a prominent investment bank on the day President Kennedy was assassinated—and nearly took down many more.

—John Coleman, the most powerful man on Wall Street in the twentieth century that you have never heard of—and why he liked it that way.

—Francine Gottfried, the humble heroine whose dignity in the face of cruel mistreatment as a result of her voluptuous figure inspired a revolution for women on Wall Street.

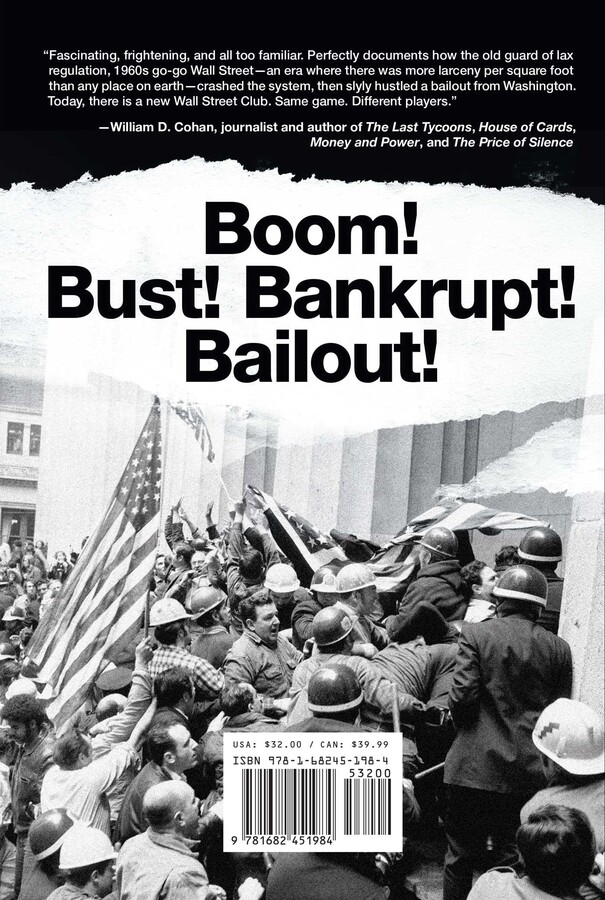

—The Hard Hat Riot of blue-collar builders of the World Trade Center who turned on the antiwar protestors and ushered in the backlash.

—The last IPO of the Go-Go Era—and perhaps the most outrageous offering in history—was of the magazine that discovered Hunter Thompson and gave birth to Gonzo Journalism.

Product Details

- Publisher: Regan Arts. (October 4, 2022)

- Length: 400 pages

- ISBN13: 9781682451984

Browse Related Books

Raves and Reviews

“Fascinating, frightening, and all too familiar. Perfectly documents how the old guard of lax regulation, 1960s go-go Wall Street—an era where there was more larceny per square foot than any place on earth—crashed the system, then slyly hustled a bailout from Washington. Today, there is a new Wall Street Club. Same game. Different player.”

– William D. Cohan, journalist and author of The Last Tycoons, House of Cards, Money and Power, and The Price of Silence

Gonzo Wall Street, indeed! A brilliant, historic account of financial incompetence and malfeasance. Urgent reading with critical lessons for today.

– Douglas E. Schoen, author of The End of Democracy and co-author of America: Unite or Die

“Farley tells a compelling, amazingly colorful story about the great financial battles that shaped public life in the 1930s and the financial institutions that both protect and imperil us now. Along with fresh details about familiar figures like FDR, Huey Long, and Joseph Kennedy, we meet several characters nearly lost to history who are more fascinating than any we have today.”

– Jonathan Alter, bestselling author of The Defining Moment: FDR's Hundred Days and the Triumph of Hope

“Richard E. Farley combines several things not often found in the same author: knowledge of the financial markets, then and now; a very good understanding of how Congress operated in the 1930s—and to a great extent still does; and a knack for writing about complex subjects in an interesting way. The result is a book which enlightens and entertains on a subject which has become as relevant as it was eighty years ago.”

– Barney Frank, former US Representative

“Richard Farley has written a comprehensive and entertaining account of the battles with Wall Street during the Depression that gave birth to the FDIC, the SEC, and the basic depositor and investor protections that we too often take for granted today. The conflicts and combatants chronicled in Wall Street Wars are similar in so many ways to those we fought during and after the 2008 Financial Crisis. This is required reading for a true understanding of why our financial system has come to work the way it does, and why we must be ever-vigilant to maintain these hard-fought protections.”

– Shelia Bair, former US FDIC Chairperson

Resources and Downloads

High Resolution Images

- Book Cover Image (jpg): Gonzo Wall Street Hardcover 9781682451984